44 difference between coupon rate and market rate

Business Finance - Interest Rates and Bond Valuation ... D. Relationship between coupon rates and market yield. C. Which of the following is not a difference between debt and equity? A. Unlike dividend omissions to equity holders, unpaid debt obligations can lead to bankruptcy B. A corporation's interest payments on debt are tax deductible, but the dividends it pays to equity holders are not Coupon Rate Definition - investopedia.com Market interest rates change over time and as they move lower or higher than a bond's coupon rate, the value of the bond increases or decreases, respectively. Since a bond's coupon rate is fixed...

Difference Between Coupon Rate and Interest Rate | Compare ... What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending.

Difference between coupon rate and market rate

Coupon vs Yield | Top 5 Differences (with Infographics) On the basis of the coupon payment and face value of the bond, the coupon rate is calculated. The yield of the bond, on the other hand, is the interest rate on the basis of the current market price Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. Whats the difference between coupon rate and the required ... I'm a little confused on the difference between the coupon rate and the required rate of return. The coupon rate (the rate the annual interest payments are based on) never changes. It is part of the bond contract between the company and the bond owners. When the bond was first issued, whenever that may have been, the coupon rate was basically set to equal to what investors required as a ... Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

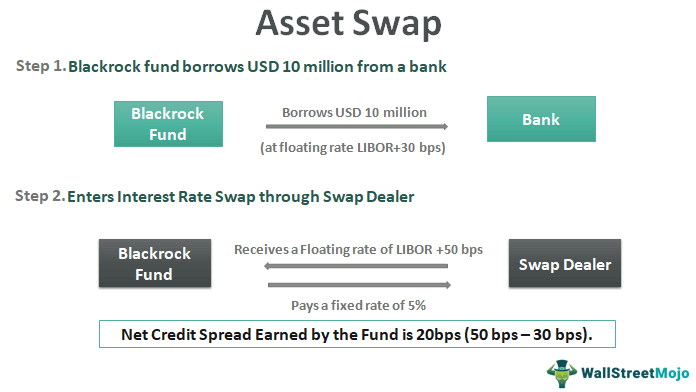

Difference between coupon rate and market rate. Difference Between Cap Rate and Discount Rate ... The cap rate allows us to value a property based on a single year's NOI. So, if a property had an NOI of $80,000 and we thought it should trade at an 8% cap rate, then we could estimate its value at $1,000,000. The discount rate, on the other hand, is the investor's required rate of return. What is the difference between discount rate and coupon ... The difference between the coupon rate and the required return of a bond is dependent upon the type of bond. Junk bonds will have the biggest difference between its return and the coupon rate. Coupon Rate vs Interest Rate | Top 8 Best Differences ... The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this. State the difference between a bond coupon rate and market ... Textbook solution for FIN.ACCTG.: ACC 101: CUSTOM TEXT+CONNEC 9th Edition Libby Chapter 10 Problem 6Q. We have step-by-step solutions for your textbooks written by Bartleby experts!

What's the Difference Between Premium Bonds and Discount ... Let's assume that those new bonds, comparable to yours in credit quality, have a coupon rate of 3%. Investors will "bid up" the price of your bond until its yield to maturity is in line with the competing market interest rate of 3%. Because of this bidding-up process, your bond will trade at a premium to its par value. Difference Between Yield & Coupon Rate | Difference Between 1.Yield rate and coupon rate are financial terms commonly used when purchasing and managing bonds. 2.Yield rate is the interest earned by the buyer on the bond purchased, and is expressed as a percentage of the total investment. Coupon rate is the amount of interest derived every year, expressed as a percentage of the bond's face value. The Difference between a Coupon and Market Rate Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary What is difference between coupon rate and interest rate ... The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

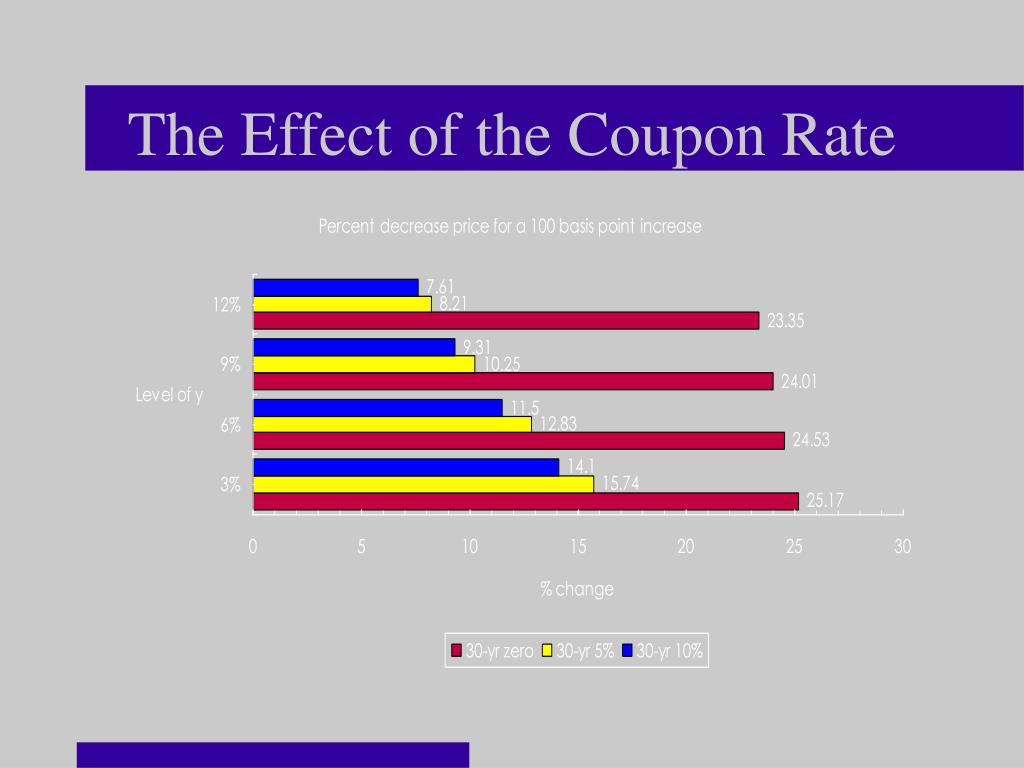

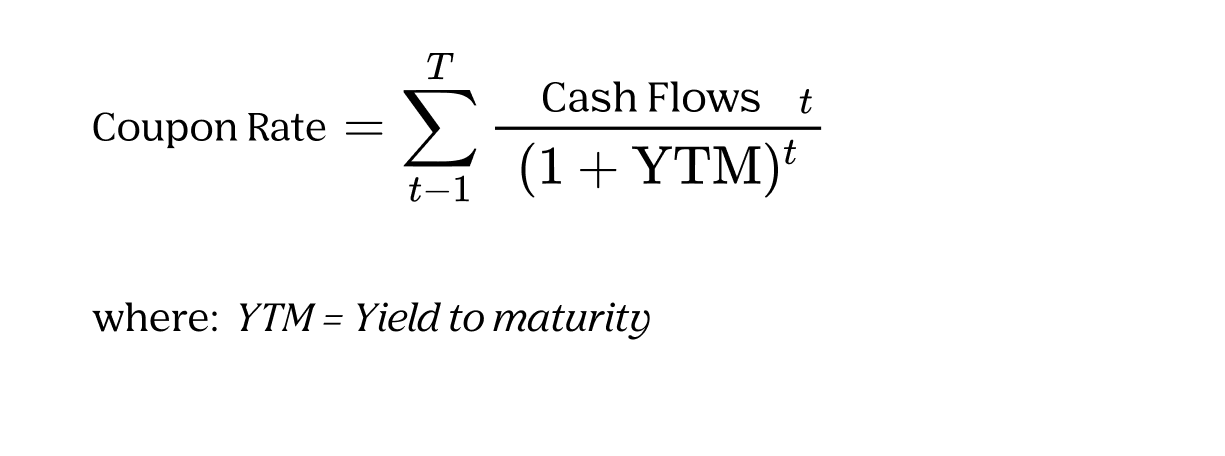

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate remains fixed over the lifetime of the bond, while the yield-to-maturity is bound to change. When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals ... Concept 82: Relationships among a Bond's Price, Coupon ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. Coupon Rate vs Interest Rate | Top 6 Best Differences ... The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Difference Between YTM and Coupon rates The YTM calculation takes into account: coupon rate, the price of the bond, time remaining until maturity, and the difference between the face value and the price. It is a rather complex calculation. The coupon rate, or, more simply stated, coupon of a particular bond, is the amount of interest paid every year.

Solved What is the difference between a bond's coupon rate ... We review their content and use your feedback to keep the quality high. 100% (2 ratings) A bond's coupon rate is the actual amount of interest income that the holder of a bond earns each year. The coupon rate …. View the full answer.

1- What is the difference between a bond's coupo… - ITProSpt The market interest rate is the percentage charged by a lender from a borrower for the amount that has been lent or for the use of assets. The difference between Coupon Rate and Interest Rate:-• Coupon Rate is the yield of fixed income security whereas Interest rate is the rate charged for borrowing.

What is the difference between coupon rate and market rate ... A coupon rate is the yield paid by a fixed income security, a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bonds face or par value. The coupon created the yield the bond paid on its issue date.

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) While calculating the current yield, the coupon rate compares to the current market price of the bond. During the tenure of the bond, the bond price remains the same till maturity due to the continuous fluctuation of the market price; it is better to buy a bond at the discount rate which offers handsome returns on the maturity at face value.

Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

Difference Between Coupon Rate and Interest Rate (With ... Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Solved The difference between the stated or coupon ... Answer = C ( Changes monthly ) Stated or coupon rate of the bond is made by the bond issuer. Coupo …. View the full answer. Transcribed image text: The difference between the stated or coupon interest rate of a bond and the market interest rate for similar investments: A. Never changes B. Changes daily C. Changes monthly.

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Whats the difference between coupon rate and the required ... I'm a little confused on the difference between the coupon rate and the required rate of return. The coupon rate (the rate the annual interest payments are based on) never changes. It is part of the bond contract between the company and the bond owners. When the bond was first issued, whenever that may have been, the coupon rate was basically set to equal to what investors required as a ...

Coupon vs Yield | Top 5 Differences (with Infographics) On the basis of the coupon payment and face value of the bond, the coupon rate is calculated. The yield of the bond, on the other hand, is the interest rate on the basis of the current market price Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold.

:max_bytes(150000):strip_icc()/GettyImages-182800841-5894f4825f9b5874ee438219.jpg)

Post a Comment for "44 difference between coupon rate and market rate"