42 how to calculate a bond's coupon rate

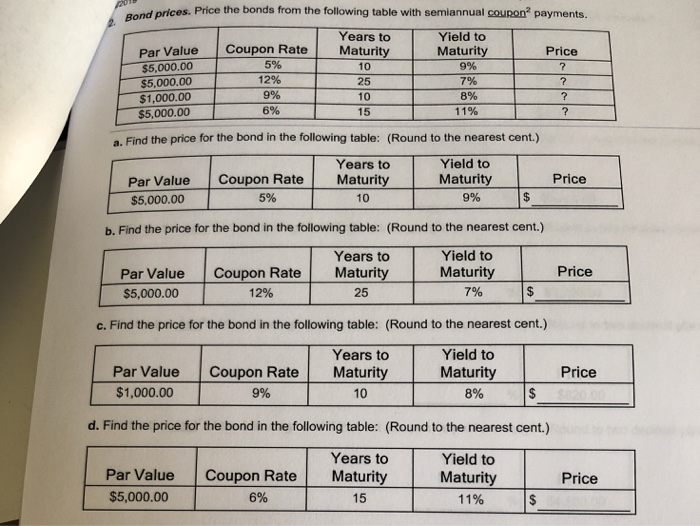

How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. How to Calculate the Price of a Bond With Semiannual ... Therefore, the example's required rate of return would be 2.5 percent per semiannual period. To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return.

How to Calculate the Annual Rate of Return on a Bond - sapling Determine how much interest you earned on the bond during the year by multiplying its face value by its coupon rate. For example, if you have a $1,000 bond with a coupon rate of 4 percent, you'd earn $40 in interest each year. Calculate how much the value of the bond appreciated during the year. Look at how much the bond was selling for on January 1, the beginning of the …

How to calculate a bond's coupon rate

Zero-Coupon Bond: Formula and Excel Calculator In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond's cash flows equal to the current market price. To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. Bond Yield Formula | Step by Step Calculation & Examples It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is calculated by multiplying the bond’s face value with the coupon rate. Calculate Bond Yield . Let us understand the bond yield equation under the current yield in detail. Bond Yield Formula = Annual Coupon Payment / Bond Price

How to calculate a bond's coupon rate. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. How To Calculate Coupon Rate - bond valuation hamilton inc ... How To Calculate Coupon Rate. Published by Jack; Sunday, May 15, 2022 ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Yield to Maturity vs. Coupon Rate: What's the Difference? 22.8.2021 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

What Is the Coupon Rate of a Bond? Coupon Rate Formula The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template What Is a Coupon Rate? How To Calculate Them & What They ... Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. For instance, say a bond has face value of $2000 and a coupon rate of 10%. Zero-Coupon Swap Definition - Investopedia 26.8.2021 · Zero Coupon Swap: A zero coupon swap is an exchange of income streams in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap , but the ...

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

How to Calculate a Coupon Payment: 7 Steps (with Pictures) To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. 3 Calculate the payment by frequency.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

How to Calculate the Rate of Return on a Coupon Bond Example: Purchase 6% coupon interest rate bond for $1,000 with 10 years to maturity. Sell the bond in one year when interest rates are 9%. What's the investo...

Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond.

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon Rate Definition A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

How to Calculate Bond Discount Rate: 14 Steps (with Pictures) Calculate the bond discount rate. This tells your the percentage, or rate, at which you are discounting the bond. Divide the amount of the discount by the face value of the bond. Using the above example, divide $36,798 by $500,000. $ 36, 798 / $ 500, 000 = .073596 {\displaystyle \$36,798/\$500,000=.073596}

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

BOND PRICING BETWEEN COUPON DATES - Bond Math - Ebrary This example breaks the bond pricing rule you no doubt remembered - "If the coupon rate equals the yield to maturity, the bond is priced at par value" - because we are now between coupon dates. Think of it this way: If you buy the bond, you need to compensate the seller for interest earned during the fraction of the period (89/180) that ...

Bond Calculator | Calculates Price or Yield Calculate either a bond's price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. If you are considering investing in a bond, and the quoted price is $93.50, enter a "0" for yield-to-maturity. Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield.

How to Calculate Compound Interest: 15 Steps (with Pictures) 4.2.2022 · Calculate interest compounding annually for year one. Assume that you own a $1,000, 6% savings bond issued by the US Treasury. Treasury savings bonds pay out interest each year based on their interest rate and current value. Interest paid in year 1 would be $60 ($1,000 multiplied by 6% = $60).

Calculate Price of Bond using Spot Rates - AnalystPrep 27.9.2019 · Spot rates are yields-to-maturity on zero-coupon bonds maturing at the date of each cash flow. Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and

Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

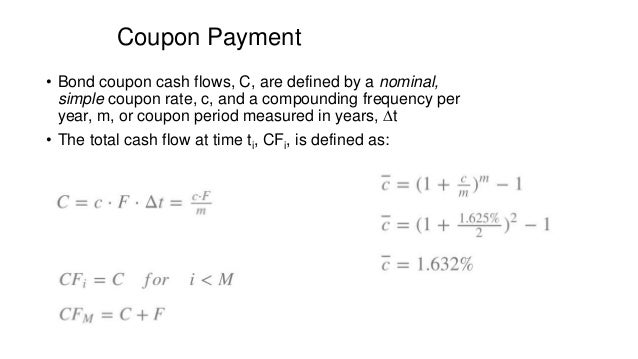

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

:max_bytes(150000):strip_icc()/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "42 how to calculate a bond's coupon rate"