38 present value formula coupon bond

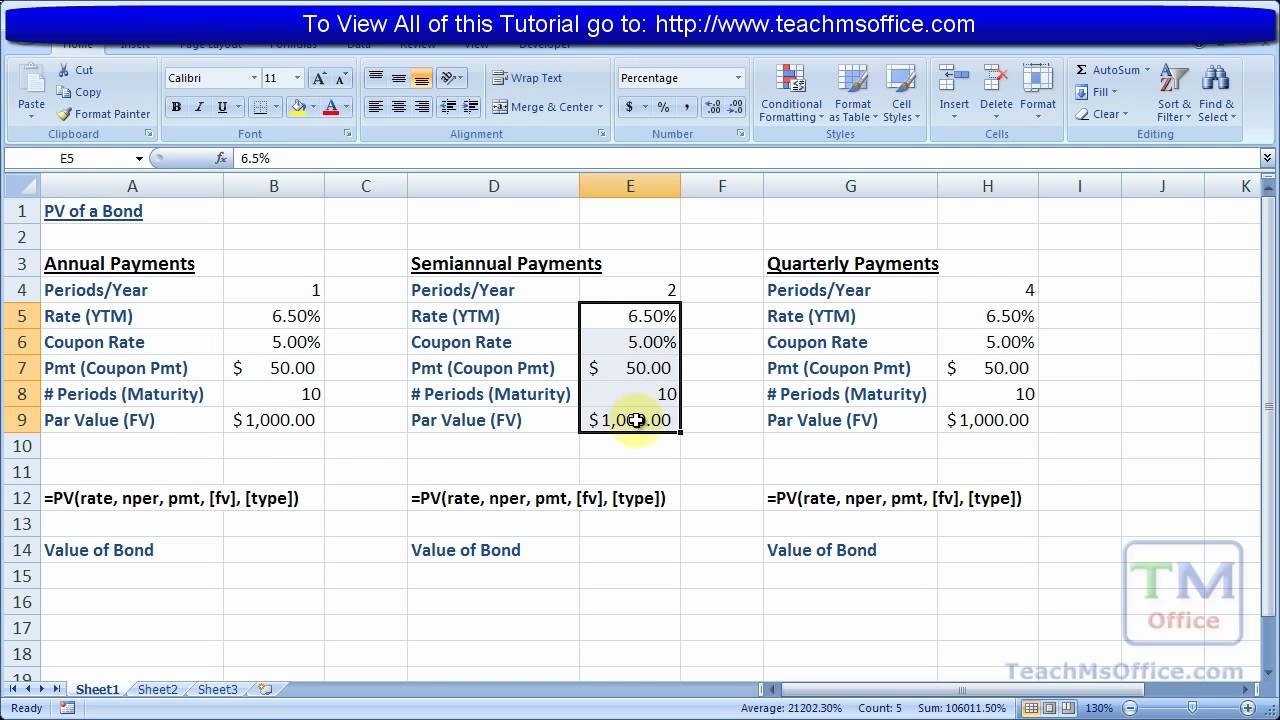

How to Calculate PV of a Different Bond Type With Excel - Investopedia 20/02/2022 · The present value of such a bond results in an outflow from the purchaser of the bond of -$796.14. Therefore, such a bond costs $796.14. C. Bonds with Bi-annual Annuities . The bond provides ... Bond Formulas - thisMatter.com Present Values and Future Values of Money ; FV, = P(1 + r) ; FV = Future Value of a dollar; P = Principal or Present Value ...

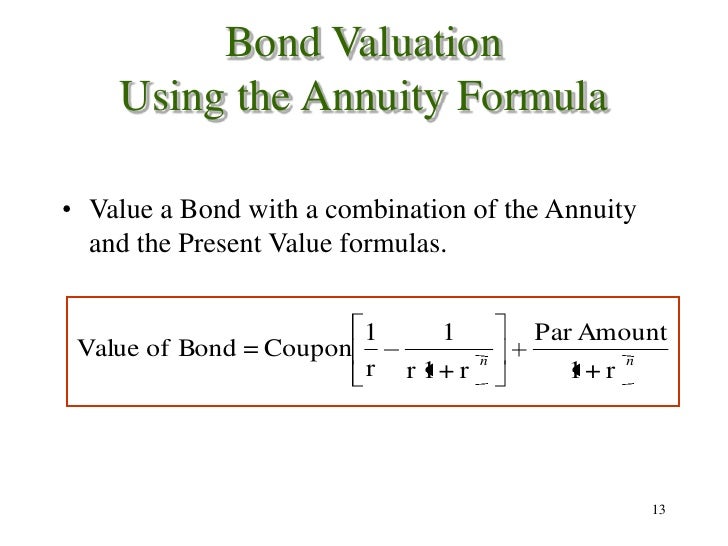

Coupon Bond Formula | Examples with Excel Template Step 7: Finally, the formula for coupon bond can be derived by summing up the present value of all the coupon payments and the par value as shown below.

Present value formula coupon bond

Present Value (PV) Definition - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... Bond Valuation Definition - Investopedia Coupon Bond Valuation — Present value of semi-annual payments = 25 / (1.015)1 + 25 / (1.015)2 + 25 / (1.015)3 + 25 / (1.015)4 = 96.36 · Present value of face ... How to Calculate Present Value of a Bond - Pediaa.Com Sep 2, 2014 — A bond is a financial debt instrument. Calculating present value of a bond involves discounting coupon income based on the market interest rate ...

Present value formula coupon bond. Present Value Factor Formula | Calculator (Excel template) As present value of Rs. 5500 after two years is lower than Rs. 5000, it is better for Company Z to take Rs. 5000 today. Explanation of PV Factor Formula. Present value means today’s value of the cash flow to be received at a future point of time and present value factor formula is a tool/formula to calculate a present value of future cash flow. Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond is calculated by discounting the bond's future cash payments by the current market interest rate. In other words, the present value ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically … Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Present Value Formula | Calculator (Examples with Excel … Step 4: Finally, the formula for present value can be derived by discounting the future cash (step 1) flow by using a discount rate (step 2) and a number of years (step 3) as shown below. PV = CF / (1 + r) t. Step 5: Further, if the number of compounding per year (n) is known, then the formula for present value can be expressed as, How to calculate the present value of a bond - AccountingTools Aug 1, 2022 — In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the ... Bond Present Value Calculator See Present Value Concepts - Calculating the Present Value of a Bond and Present Value of a Bond Formula for discussions on computing the present value of bonds. Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Yield to Maturity Calculator Zero Coupon ... Excel formula: Present value of annuity | Exceljet nper - the value from cell C8, 25. pmt - the value from cell C6, 100000. fv - 0. type - 0, payment at end of period (regular annuity). Annuity due. With an annuity due, payments are made at the beginning of the period, instead of the end. To calculate present value for an annuity due, use 1 for the type argument. In the example shown, the ...

Zero Coupon Bond Value - Formula (with Calculator) - finance … After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. In this example, we suppose that ... Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. How to Calculate Present Value of a Bond - Pediaa.Com Sep 2, 2014 — A bond is a financial debt instrument. Calculating present value of a bond involves discounting coupon income based on the market interest rate ... Bond Valuation Definition - Investopedia Coupon Bond Valuation — Present value of semi-annual payments = 25 / (1.015)1 + 25 / (1.015)2 + 25 / (1.015)3 + 25 / (1.015)4 = 96.36 · Present value of face ...

Present Value (PV) Definition - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Post a Comment for "38 present value formula coupon bond"