39 yield to maturity of zero coupon bond

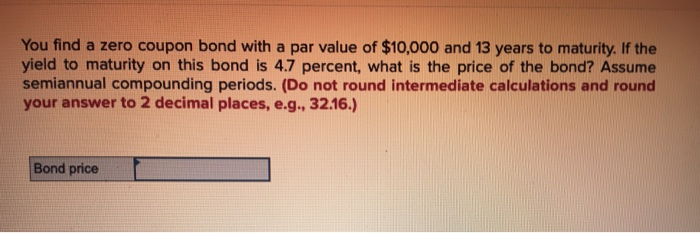

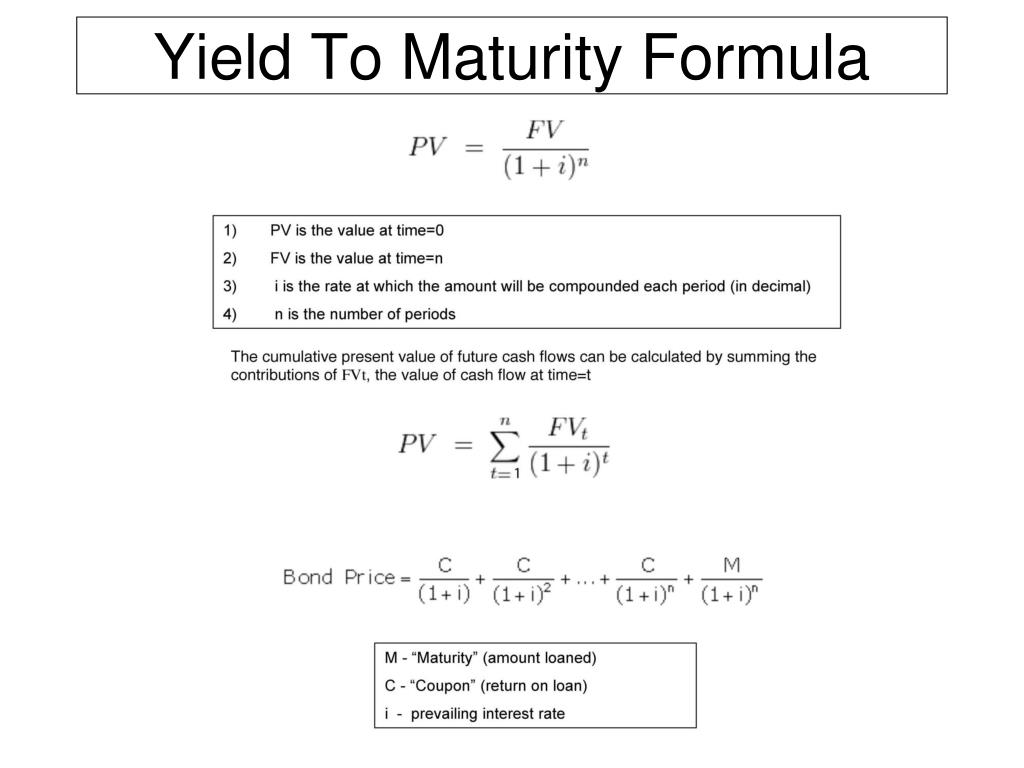

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Jul 15, 2022 · Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon bonds always... To calculate the price for a given yield to - zwm.prestige-ddd.pl To calculate the price for a given yield to maturity see the Bond Price Calculator.Face Value This is the nominal value of debt that the bond represents. It is the amount that is payed to the holder of the bond on the date that it matures, also called the redemption date. Coupon Rate. Price versus Maturity.When a bond is redeemed at maturity, the bondholder receives the bond's par value from ...

Bonds Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond matures in eight years, the bond should sell for a price of _______ today.

Yield to maturity of zero coupon bond

Solved 15, A zero-coupon bond has a yield to maturity of 9% - Chegg Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16. Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [{F/PV}]^(1/t) =1+r. Where. F -face value of the bond. PV- current value of the bond. t -time to maturity. r- Interest rate. For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of ... Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

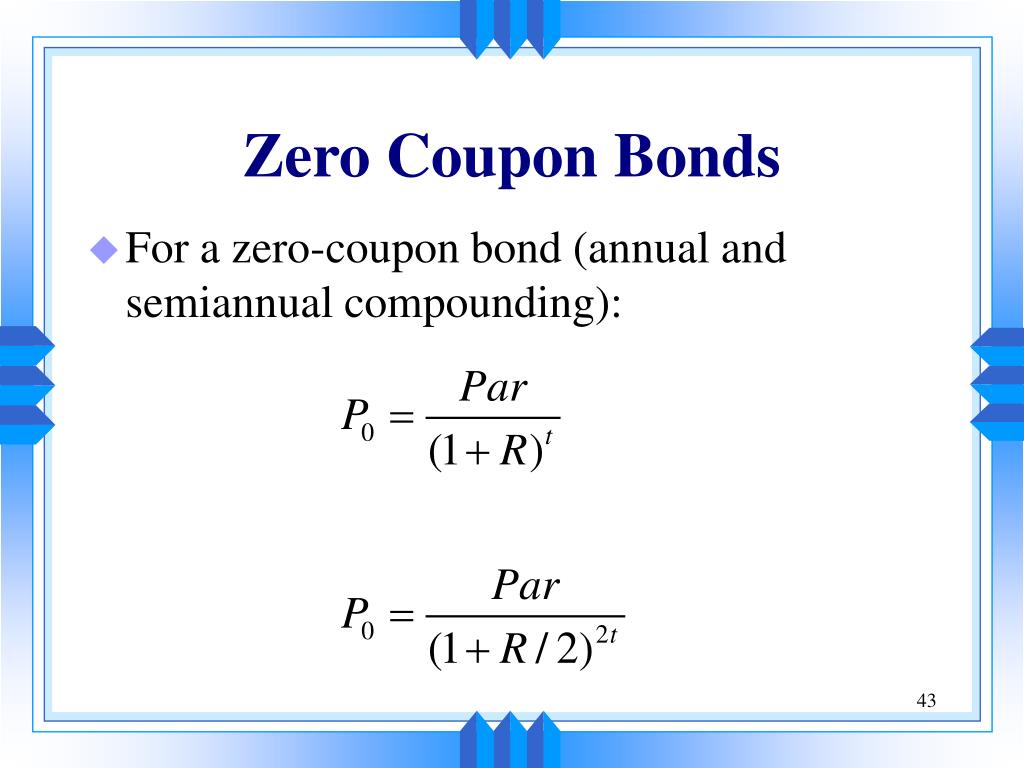

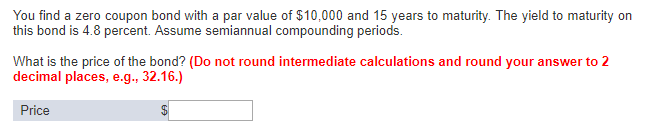

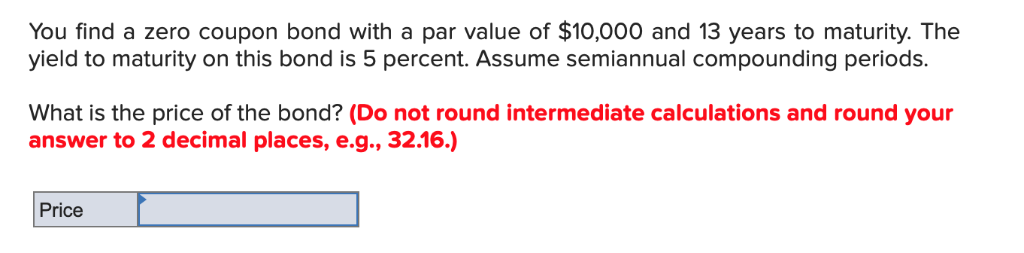

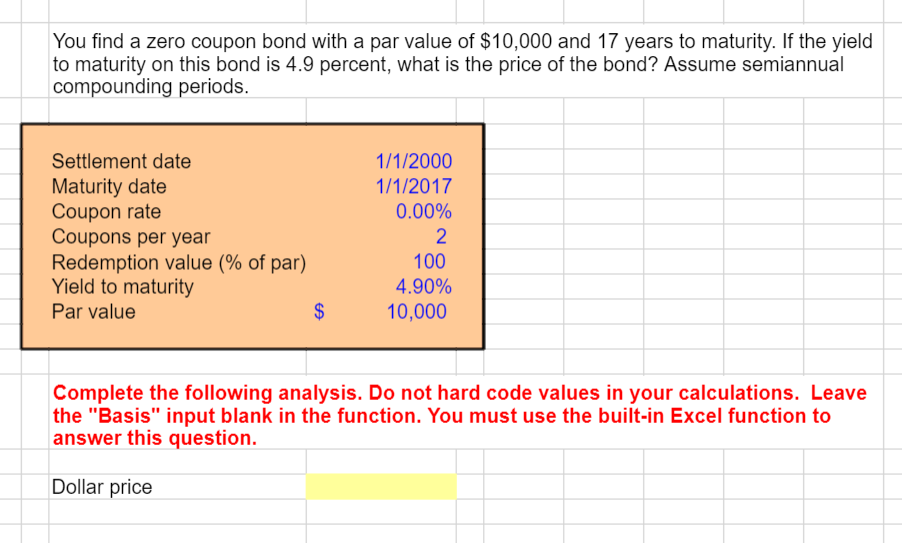

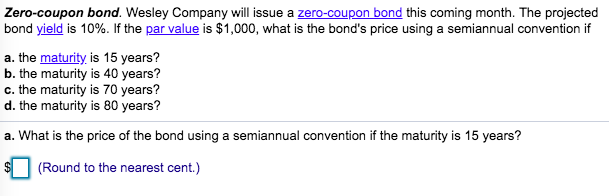

Yield to maturity of zero coupon bond. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) – 1 Zero-Coupon Bond Risks Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical ... Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term. Yield to Maturity (YTM) Definition - Investopedia 31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , …

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = Example 1. Consider a 30-year zero-coupon bond with a face value ... Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds For bonds with multiple coupons, it is not generally possible to solve for yield in terms … Zero-Coupon Bond - Definition, How It Works, Formula Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53. Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

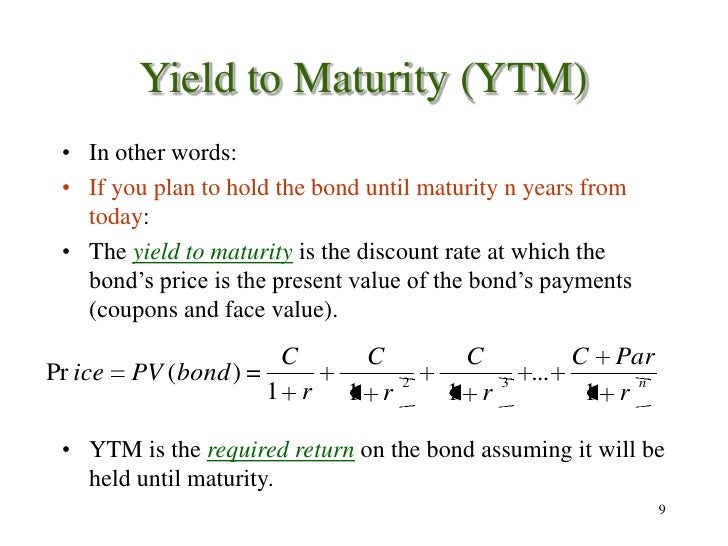

Yield to Maturity (YTM) Definition - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world.

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

What is the difference between a zero-coupon bond and a regular bond? A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher ...

Zero-Coupon Bond Definition - Investopedia 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What is the yield to maturity (YTM) of a zero coupon bond with a face ... Answer (1 of 2): YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 ->...

Zero-Coupon Bond Definition - Investopedia Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax Zero-Coupon Bonds? Imputed interest, sometimes referred to as "phantom...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... P = M / (1+r)n variable definitions: 1. P = price 2. M = maturity value 3. r = annual yield divided by 2 4. n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price o...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Bond Yield to Maturity Calculator for Comparing Bonds Long term securities, particularly zero coupon bonds, can pay predictable dividends if you are willing to ride out the changes in the market, and hold on to your investments until they reach absolute maturity. If you know how to manage your portfolio, or hire a money manager to handle your investments, you can maximize your gains by selling portions of your holdings when …

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of …

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

Post a Comment for "39 yield to maturity of zero coupon bond"