43 duration of a coupon bond

BGF US Dollar Short Duration Bond Fund | D2 - BlackRock Key Facts. Size of Fund (Millions) as of Jul 29, 2022 USD 1,585.943. 12m Trailing Yield -. Number of Holdings as of Jun 30, 2022 871. Base Currency U.S. Dollar. Fund Inception Date Oct 31, 2002. Share Class Inception Date Oct 25, 2012. Asset Class Fixed Income. Morningstar Category USD Diversified Bond - Short Term. Vanguard Intermediate-Term, Long-Term Treasury: Choices For UST Bond ... The current portfolio holds 68 bonds with an WAM of 23.5 years and duration of 16.9 years. The portfolio has an average coupon of 2.6% and YTM of 3.3%. It maturity allocation is as follows:

AGG | ETF Snapshot - Fidelity The investment seeks to track the investment results of the Bloomberg U.S. Aggregate Bond Index. The index measures the performance of the total U.S. investment-grade bond market. The fund will invest at least 80% of its assets in the component securities of the underlying index and TBAs that have economic characteristics that are substantially ...

Duration of a coupon bond

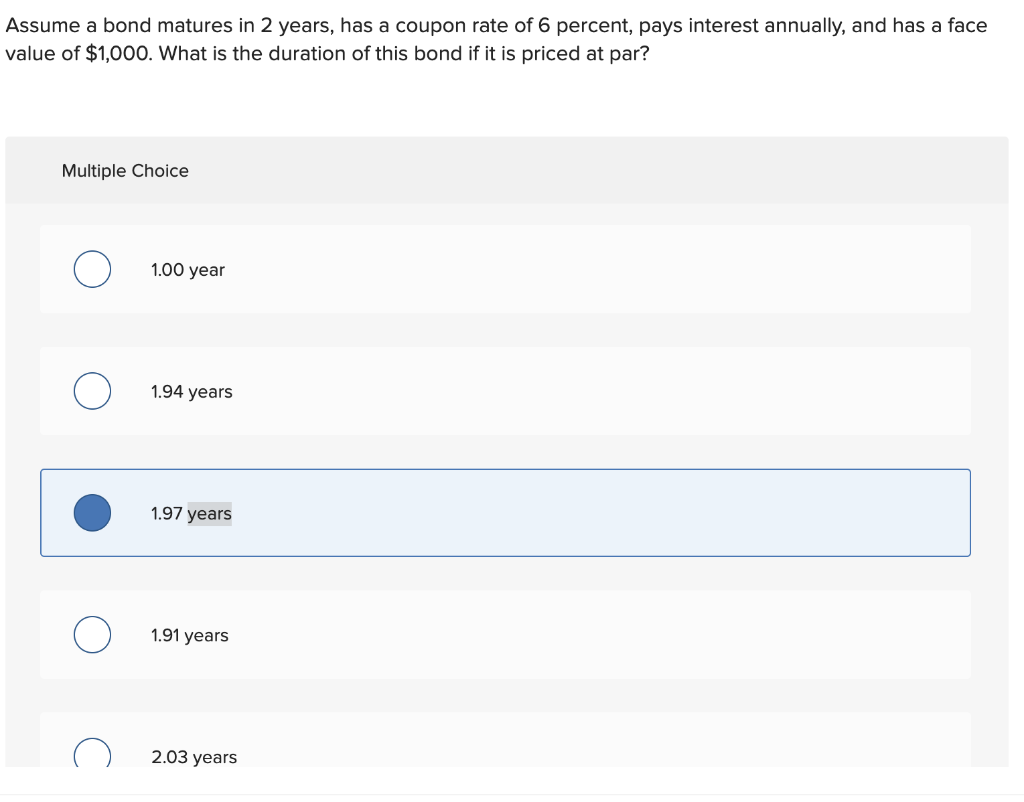

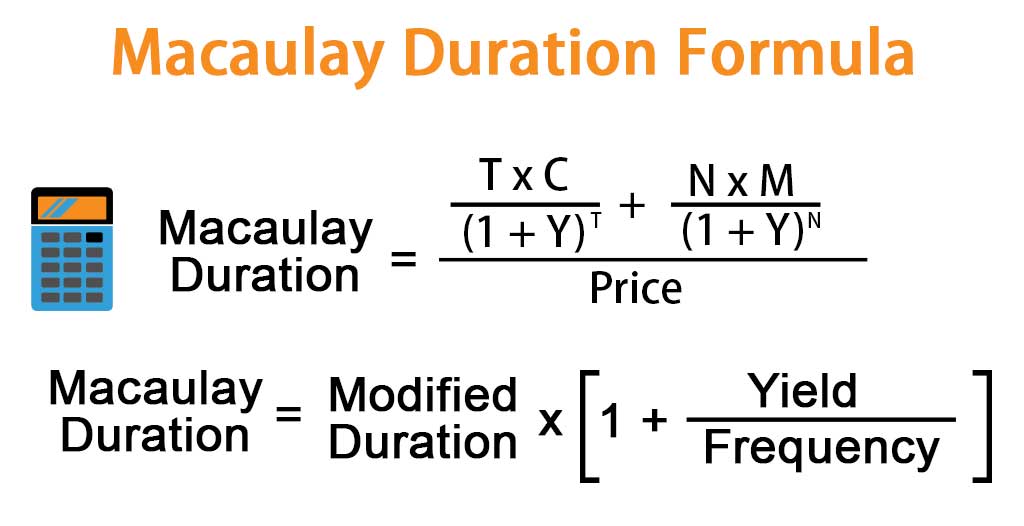

Bond Basics: Understand the Ins and Outs of the Bond Market, Part I A 10-year callable bond sold at a discount of $980 with a 5% CY, or $50 coupon rate, called at 5 years and redeemed for $1040 will have a YTC of 6.17%; Duration. A bond's Duration is the amount of time you need to be invested in a bond to recoup the cost of your initial investment. Bonds with high Current Yields and shorter maturity dates ... iShares 7-10 Year Treasury Bond ETF | IEF - BlackRock The iShares 7-10 Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years. Long Term Government Bond ETF List - ETF Database Long Term Government Bond ETFs provide investors with exposure to the long side of the U.S. bond market. These funds focus on debt sponsored by the U.S. government or its agencies and can include Treasuries, MBS, TIPS or other debt. Long-term bonds generally have maturities longer than 10 years. Click on the tabs below to see more information ...

Duration of a coupon bond. U.S. Treasury Bond Overview - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. Latest Interest Rates news ... volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings ... Short Duration Fund | American Century Investments W2 Minimum initial investment is $1,000 for IRA and CESA accounts, and $2,500 for non-retirement accounts, but these minimums are waived with an initial investment of at least $500 per account and automatic investments of at least $100 per month. WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 134 ... How Can I Calculate a Bond's Coupon Rate in Excel? A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ...

FBND | ETF Snapshot - Fidelity Weighted Average Duration (Yrs) AS OF 06/30/2022: 6.23: Weighted Average Maturity (Yrs) AS OF 06/30/2022: 8.87: Weighted Average Coupon AS OF 06/30/2022: 3.15%: 30-day SEC Yield AS OF 06/30/2022: 3.87%: Distribution Yield (TTM) AS OF 06/30/2022 ... Bonds are typically classified into the following three categories: Short-Term (bills ... United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.654% yield.. 10 Years vs 2 Years bond spread is -23.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.50% (last modification in July 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 20.20 and implied probability of ... ANALYSIS-World's biggest bond markets back in vogue as recession fears ... Total returns, including capital gains and coupon payments, on Austria's 100-year bonds AT0000A2HLC4 are up 33% in July, according to Refinitiv data. But as with most very long-dated debt an ... AMAZON.COM INC.DL-NOTES 2017(17/27) Bond - Insider The payment of the coupon will take place 2.0 times per biannual on the 22.02.. At the current price of 100.8 USD this equals a annual yield of 3.20%. The Amazon.com Inc.-Bond was issued on the 8 ...

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.360% yield.. 10 Years vs 2 Years bond spread is 352 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.50% (last modification in July 2022).. The South Africa credit rating is BB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%. iShares U.S. Treasury Bond ETF | GOVT Key Facts. Net Assets of Fund as of Jul 28, 2022 $23,024,556,462. Fund Inception Feb 14, 2012. Exchange Cboe BZX formerly known as BATS. Asset Class Fixed Income. Benchmark Index ICE US Treasury Core Bond Index. Bloomberg Index Ticker IDCOTC4. Shares Outstanding as of Jul 28, 2022 949,600,000. Distribution Frequency Monthly. Libra Bank pays 6.5% fixed coupon on 10-year bonds denominated in euros It is Libra's third bond, with the latest one (of EUR4.3 mln and EUR 500 face value), maturing in 2030, trading on BVB at a yield to maturity of 4.9% resulting from the 5% coupon and a trading ... SPDR® Bloomberg Short Term High Yield Bond ETF SJNK The SPDR ® Bloomberg Short Term High Yield Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index (the "Index") Seeks to provide diversified exposure to short-term US dollar-denominated high yield ...

iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD iShares iBoxx $ Investment Grade Corporate Bond ETF. Visit Portfolio Tool. Add to Compare. NAV as of Jul 28, 2022 $113.81. 52 WK: 107.44 - 136.20. 1 Day NAV Change as of Jul 28, 2022 0.89 (0.79%) NAV Total Return as of Jul 28, 2022 YTD: -13.05%. Fees as stated in the prospectus Expense Ratio: 0.14%. Overview.

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.320% yield.. 10 Years vs 2 Years bond spread is 91.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

Long Term Government Bond ETF List - ETF Database Long Term Government Bond ETFs provide investors with exposure to the long side of the U.S. bond market. These funds focus on debt sponsored by the U.S. government or its agencies and can include Treasuries, MBS, TIPS or other debt. Long-term bonds generally have maturities longer than 10 years. Click on the tabs below to see more information ...

iShares 7-10 Year Treasury Bond ETF | IEF - BlackRock The iShares 7-10 Year Treasury Bond ETF (IEF) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven and ten years.

Bond Basics: Understand the Ins and Outs of the Bond Market, Part I A 10-year callable bond sold at a discount of $980 with a 5% CY, or $50 coupon rate, called at 5 years and redeemed for $1040 will have a YTC of 6.17%; Duration. A bond's Duration is the amount of time you need to be invested in a bond to recoup the cost of your initial investment. Bonds with high Current Yields and shorter maturity dates ...

:max_bytes(150000):strip_icc()/dur1-5c0b038cc9e77c0001543188.jpg)

Post a Comment for "43 duration of a coupon bond"