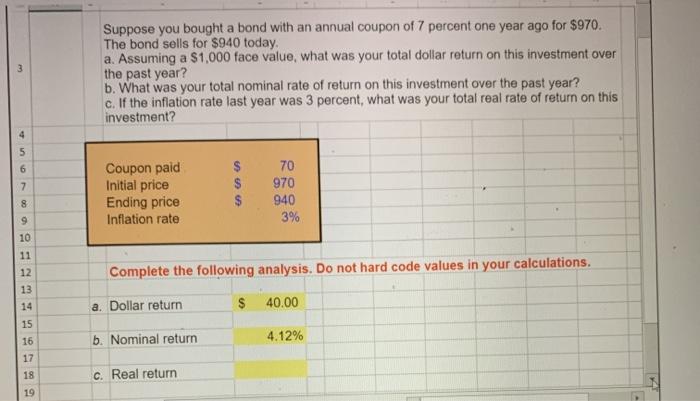

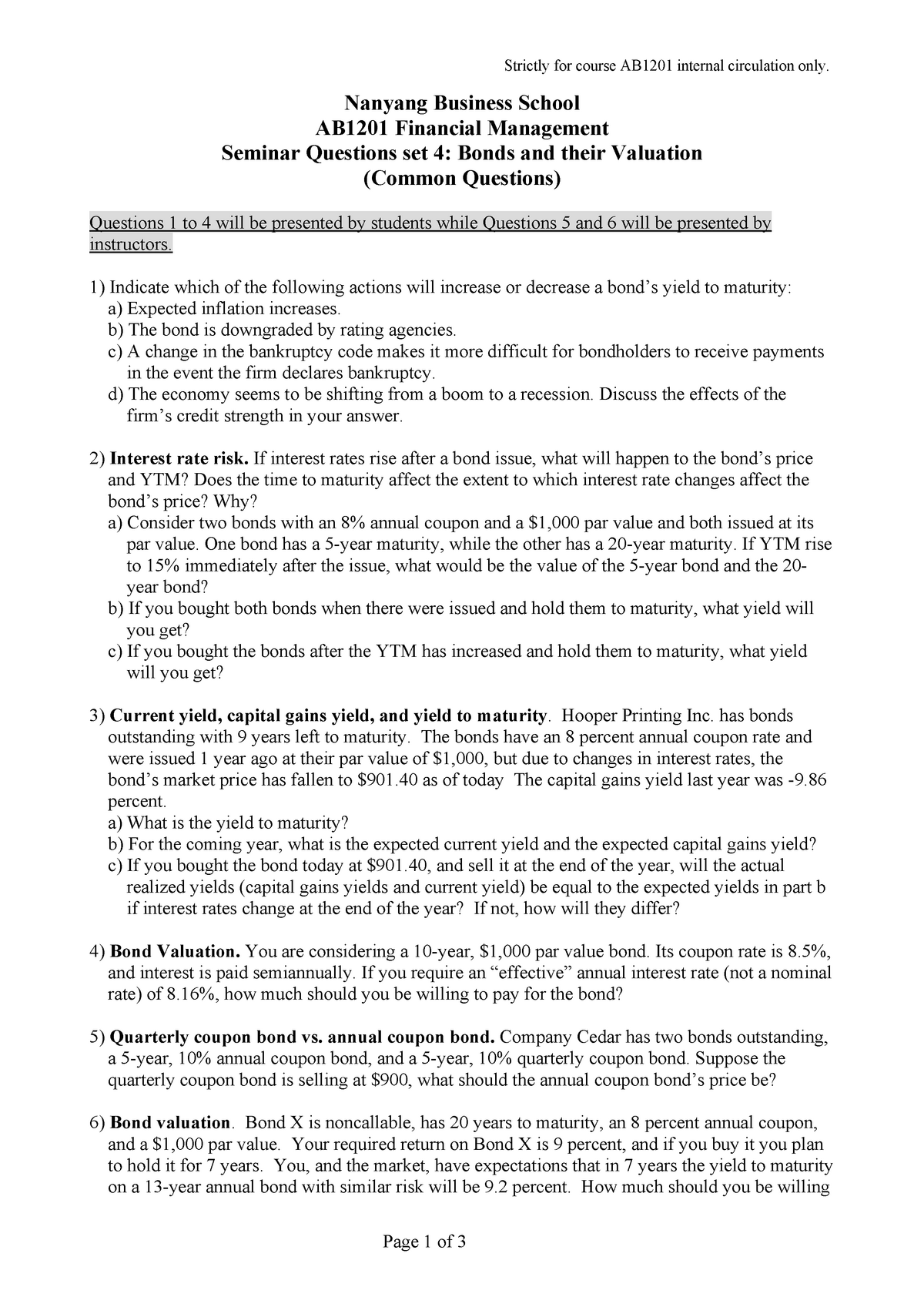

43 suppose you bought a bond with an annual coupon of 7 percent

› createJoin LiveJournal By creating an account on LiveJournal, you agree to our User Agreement. Create account . Or you can use social network account to register. Welcome . Create First Post . fortune.comFortune - Fortune 500 Daily & Breaking Business News | Fortune Oct 18, 2022 · The Best MBA Programs in 2022 Fortune Education wants to help you decipher the best of what the business school landscape has to offer. Discover which 76 schools made our second annual ranking of ...

› questions-and-answers › supposeAnswered: Suppose you invest $8,000 in a mutual… | bartleby Oct 10, 2022 · Q: Assume that you can invest to earn a stated annual rate of return of 12 percent, but where interest… A: Semiannual interest rate (r) = 0.06 (i.e. 0.12 / 2) Number of deposits (n) = 20 Semiannual period…

Suppose you bought a bond with an annual coupon of 7 percent

assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. › investors › learn-to-investMutual Funds | FINRA.org Suppose, for example, that the management and administrative fees of an actively managed fund are 1.5 percent of the fund's total assets and the fund's benchmark provided a 9 percent return. To beat that benchmark, the portfolio manager would need to assemble a fund portfolio that returned better than 10.5 percent before fees were taken out. › questions-and-answers › susanAnswered: Susan bought a 18-year bond when it was… | bartleby Oct 13, 2022 · Susan bought a 18-year bond when it was issued by Octodan Corporation 2 years ago (NOTE: the bond was issued 2 years ago. In calculating price today, remember it has only 16 years remaining to maturity). The bond has a $1,000 face value, an annual coupon rate equal to 8 percent and the coupons are paid every six months.

Suppose you bought a bond with an annual coupon of 7 percent. › publication › 267151826(PDF) Multiple Choice Questions and Answers:Capital Structure ... Jan 16, 2014 · the company the investor requires a n annual return of 13 percent. The company's share price is still cum div and the c urrent divi dend (to be pai d sh ortly) is 23p pe r share. › questions-and-answers › susanAnswered: Susan bought a 18-year bond when it was… | bartleby Oct 13, 2022 · Susan bought a 18-year bond when it was issued by Octodan Corporation 2 years ago (NOTE: the bond was issued 2 years ago. In calculating price today, remember it has only 16 years remaining to maturity). The bond has a $1,000 face value, an annual coupon rate equal to 8 percent and the coupons are paid every six months. › investors › learn-to-investMutual Funds | FINRA.org Suppose, for example, that the management and administrative fees of an actively managed fund are 1.5 percent of the fund's total assets and the fund's benchmark provided a 9 percent return. To beat that benchmark, the portfolio manager would need to assemble a fund portfolio that returned better than 10.5 percent before fees were taken out. assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "43 suppose you bought a bond with an annual coupon of 7 percent"