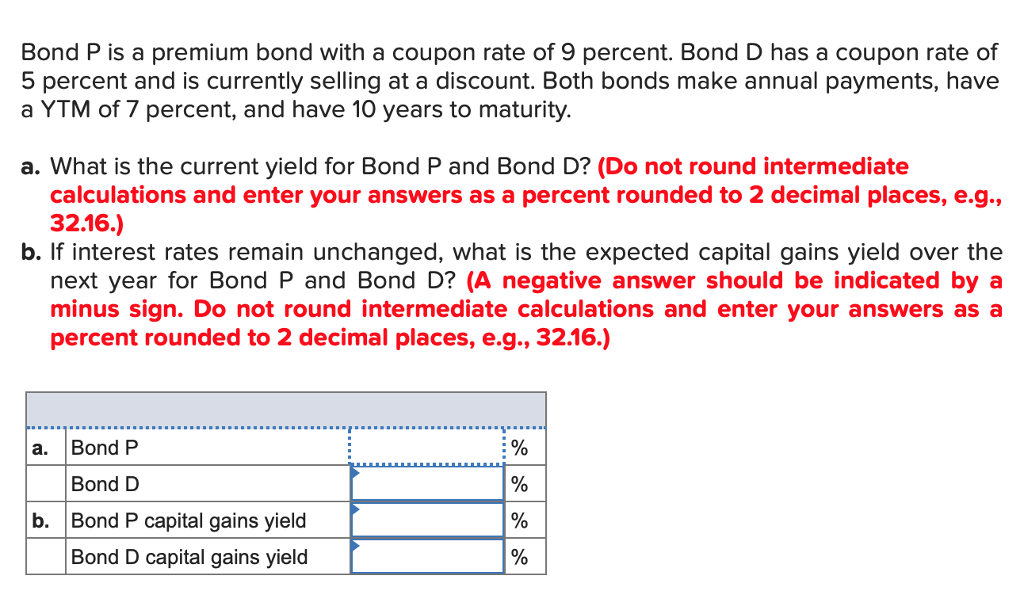

38 coupon rate vs ytm

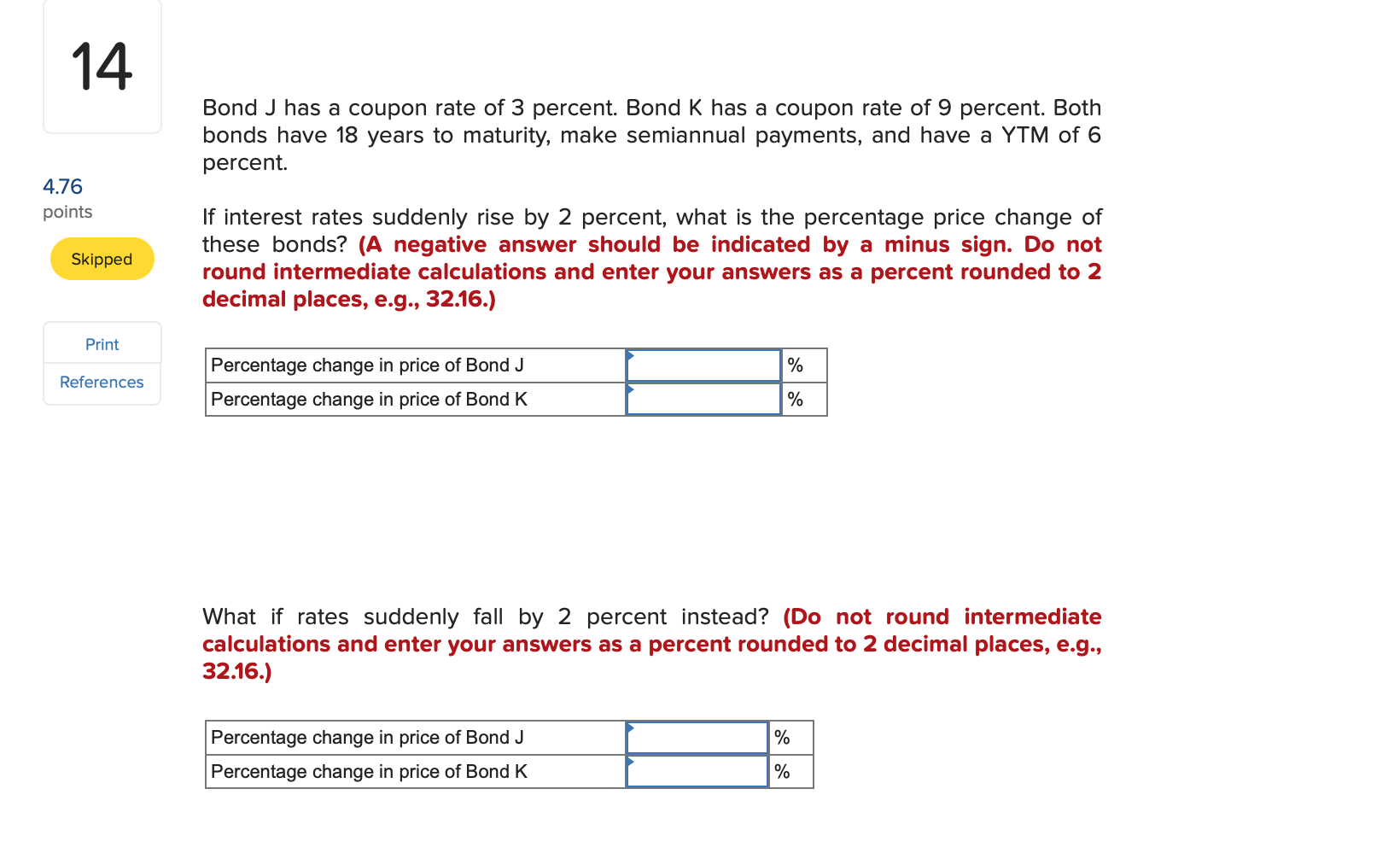

Duration Definition and Its Use in Fixed Income Investing - Investopedia WebSep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... Coupon Rate Definition - Investopedia WebMay 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

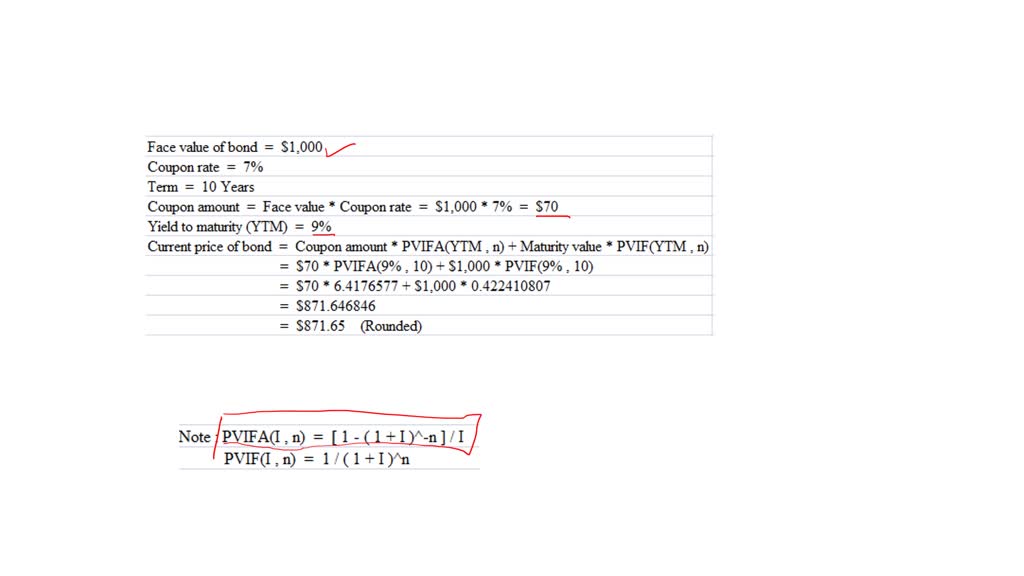

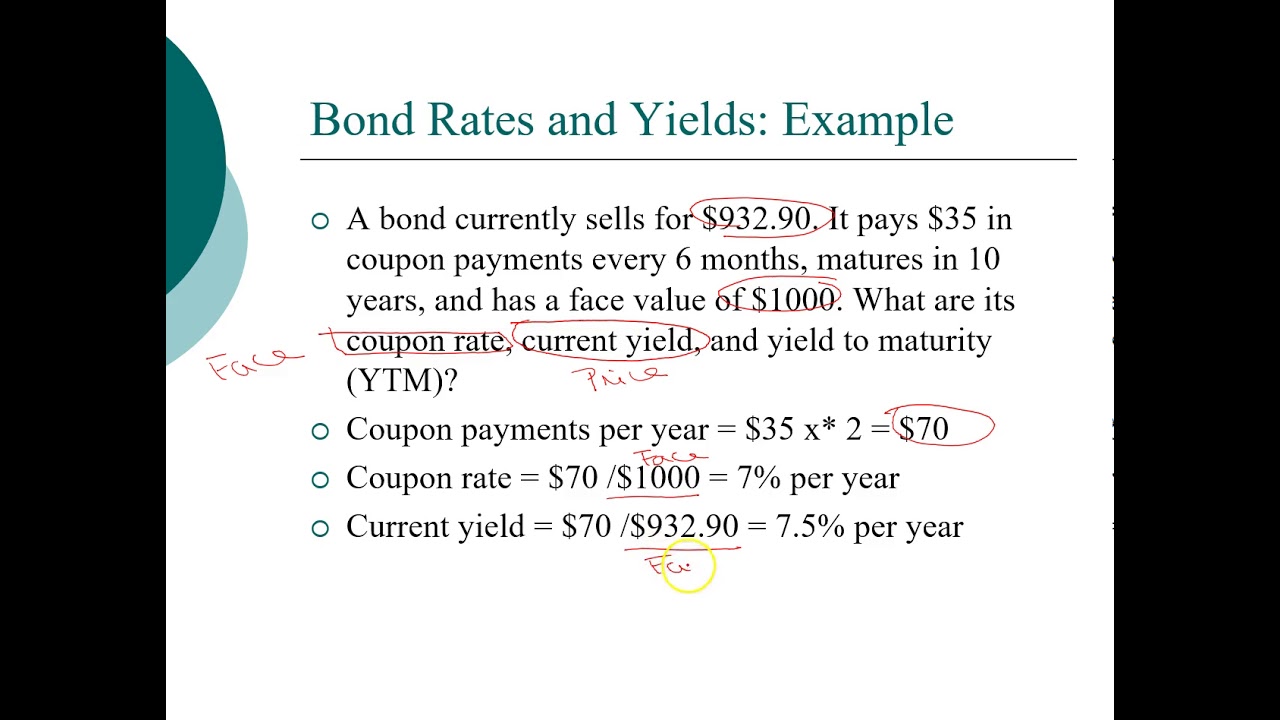

Bond Yield: Formula and Percent Return Calculation WebCalculating the current yield of a bond is a three-step process: Step 1: The current bond price can be readily observed in the markets – in which the bond can either trade at a discount, at par or at a premium to par.; Step 2: The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the coupon …

Coupon rate vs ytm

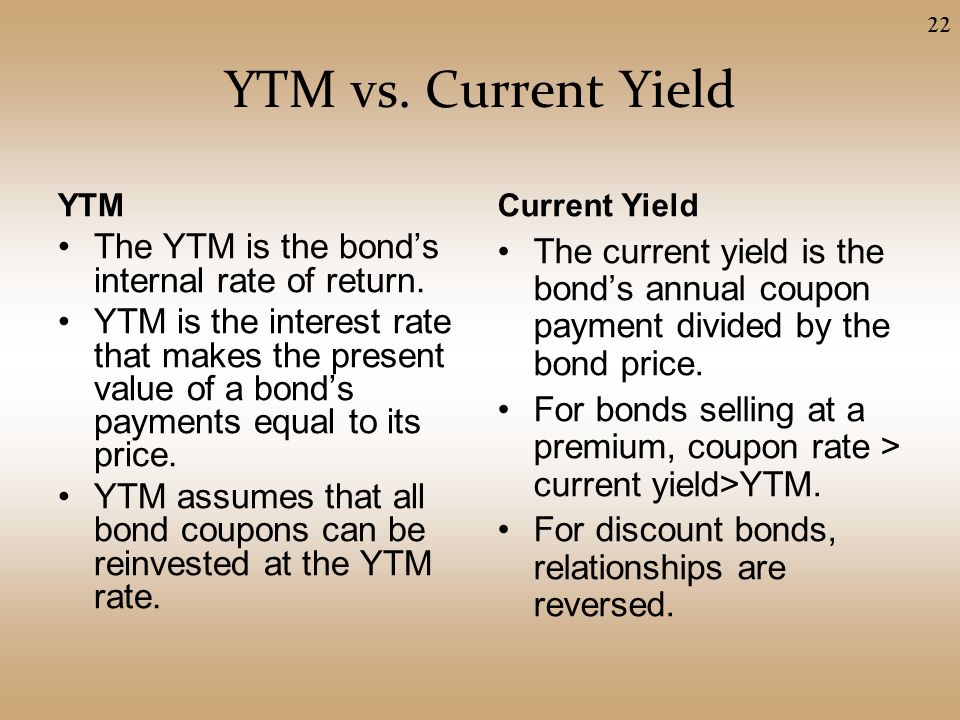

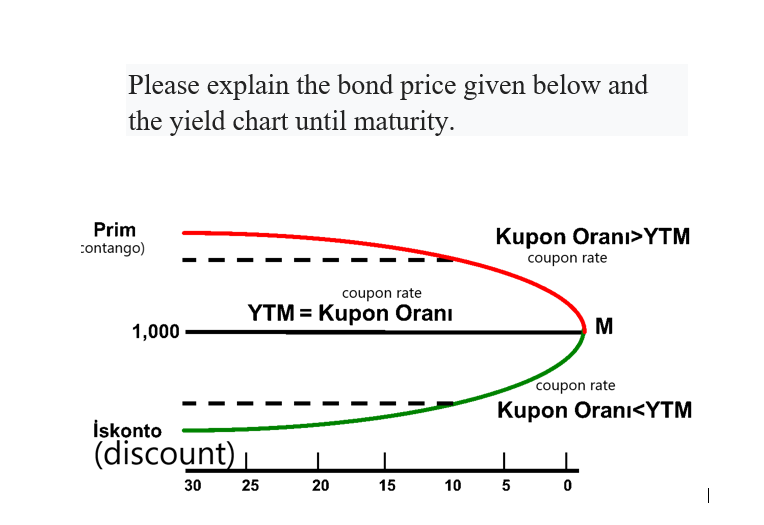

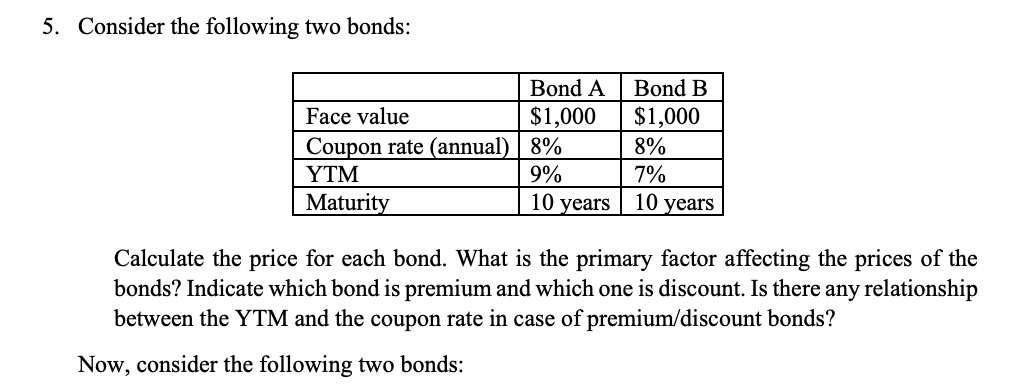

Coupon vs Yield | Top 5 Differences (with Infographics) WebThe yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic. Let’s see the top differences between coupon vs. yield. ... Coupon Rate Yield; Definition: How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia WebOct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Yield to maturity - Wikipedia WebThe yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal …

Coupon rate vs ytm. Yield to Maturity (YTM): What It Is, Why It Matters, Formula WebMay 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Yield to Maturity (YTM): Formula and Bond Calculation WebYTM > Coupon Rate and Current Yield → The bond is being sold at a “discount” to its par value. YTM = Coupon Rate and Current Yield → The bond is said to be “trading at par”. How to Interpret YTM in Bond Percent Yield Analysis. By understanding the YTM formula, investors can better predict how changing market conditions could impact ... Interest Rate Statistics | U.S. Department of the Treasury WebTo estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Yield to maturity - Wikipedia WebThe yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal … How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia WebOct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Coupon vs Yield | Top 5 Differences (with Infographics) WebThe yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic. Let’s see the top differences between coupon vs. yield. ... Coupon Rate Yield; Definition:

Post a Comment for "38 coupon rate vs ytm"