40 present value of coupon bond calculator

Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. Present Value of Future Money Future Value (FV) Number of Periods (N) Interest Rate (I/Y) Results Present Value: $558.39 Total Interest: $441.61 Present Value of Periodical Deposits Results Bond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ...

Calculate the Value of Your Paper Savings Bond(s) - TreasuryDirect The Savings Bond Calculator WILL: Calculate the value of a paper bond based on the series, denomination, and issue date entered. (To calculate a value, you don't need to enter a serial number. However, if you plan to save an inventory of bonds, you may want to enter serial numbers.) Store savings bond information you enter so you can view or update it later.

Present value of coupon bond calculator

› calculator › present_value_calculatorPresent Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ... Zero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Present Value Formula | Calculator (Examples with Excel … Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ...

Present value of coupon bond calculator. Coupon Bond Present Value Calculator - fishfinderdiscounts.com Free unlimited Coupon Bond Present Value Calculator with listing websites included hot deals, promo codes, discount codes, free shipping. Fish Finder Discounts. Hot Deal; Submit Coupon; ... FREE From buyupside.com Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value ... Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. › present-value-formulaPresent Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ... Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value

Zero Coupon Bond Calculator - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value. P = price. n = years until maturity. Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Present Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation.. See How Finance Works for the present value formula.. You can also sometimes estimate present value with The Rule of 72. Bond Present Value Calculator - UltimateCalculators.com Use the present value of a bond calculator below to solve the formula. Present Value of a Bond Definition Present Value of a Bond is the value of a bond equal to the discounted remaining interest payments and the discounted redemption value of the bond certificate. Variables PV of Bond=Current market value of bond

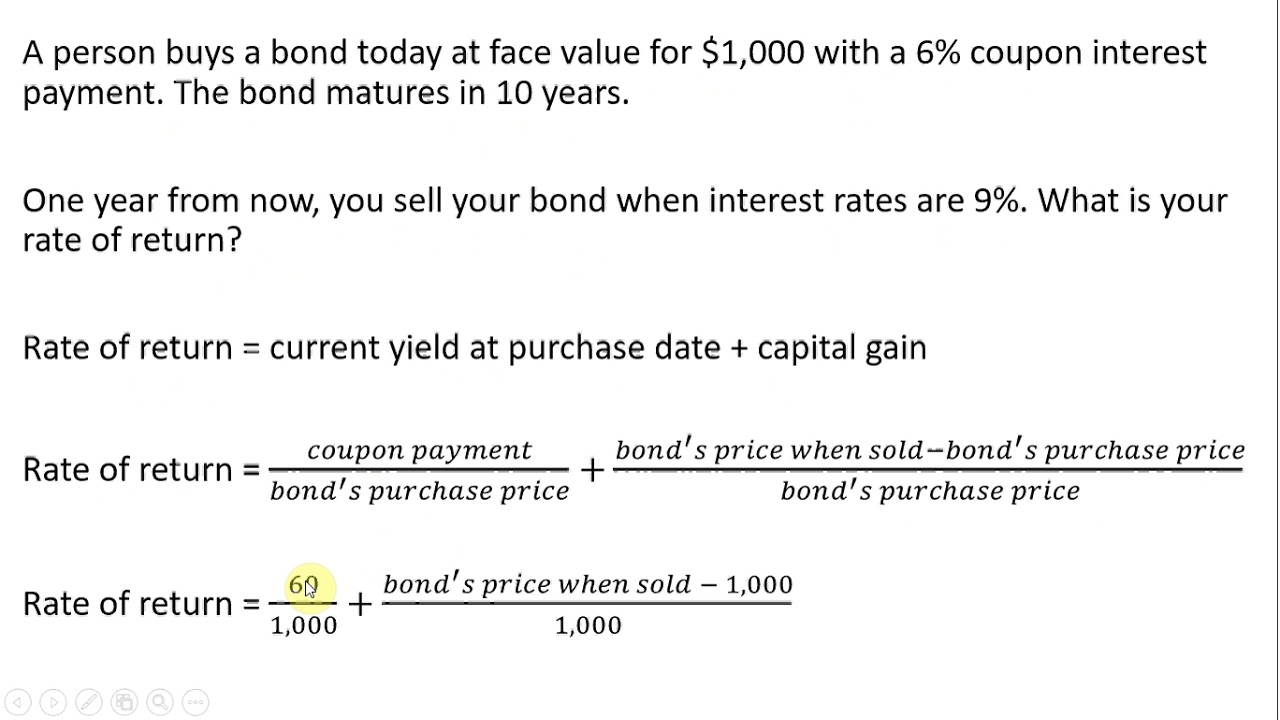

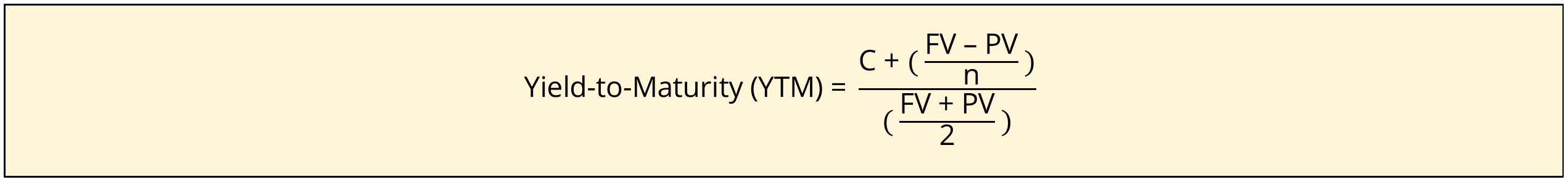

Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. Five inputs are needed to use the "Rate" function; time left ... › calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Bond Yield to Maturity Calculator for Comparing Bonds Estimate the Present Value of Multiple Bonds. Bond Price Calculator: Figure the Market Value of Bonds ... The coupon is expressed as a percentage of the bond's face value. So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be ... dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50. With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

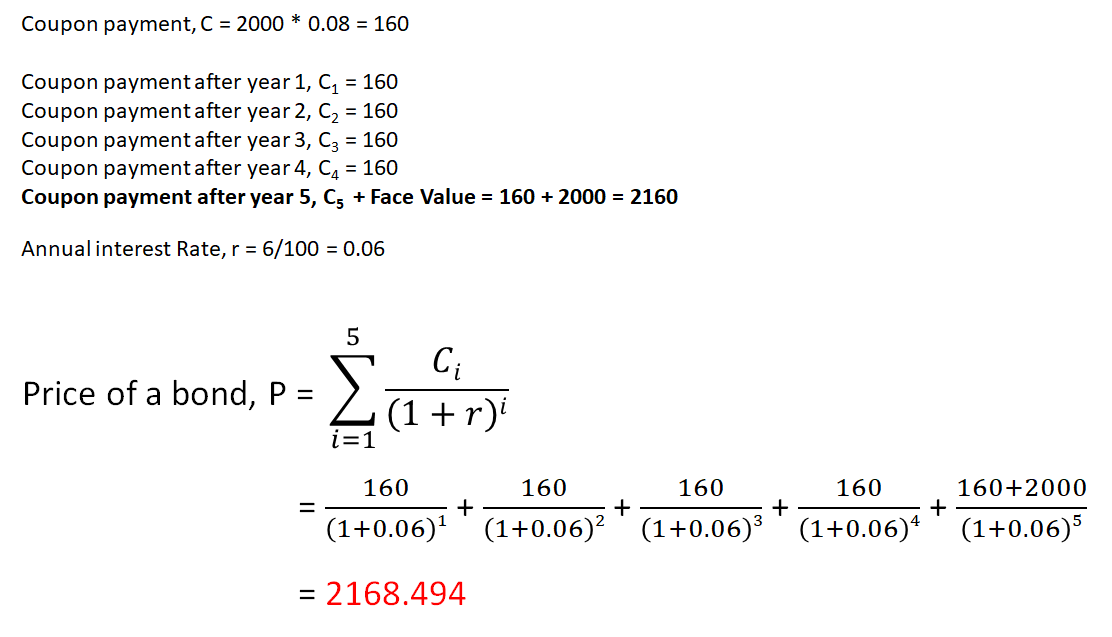

Present Value Coupon Bond Calculator - Bizim Konak (Just Now) The total present value of the bond can be represented as, Calculate Present value of a bond - Example: Following information is given with regard to the bond issue of ABC Company. Face value of the bond - $ 2000 Maturity period of the bond - 5 years Annual coupon rate - 9% Market interest rate - 10%.

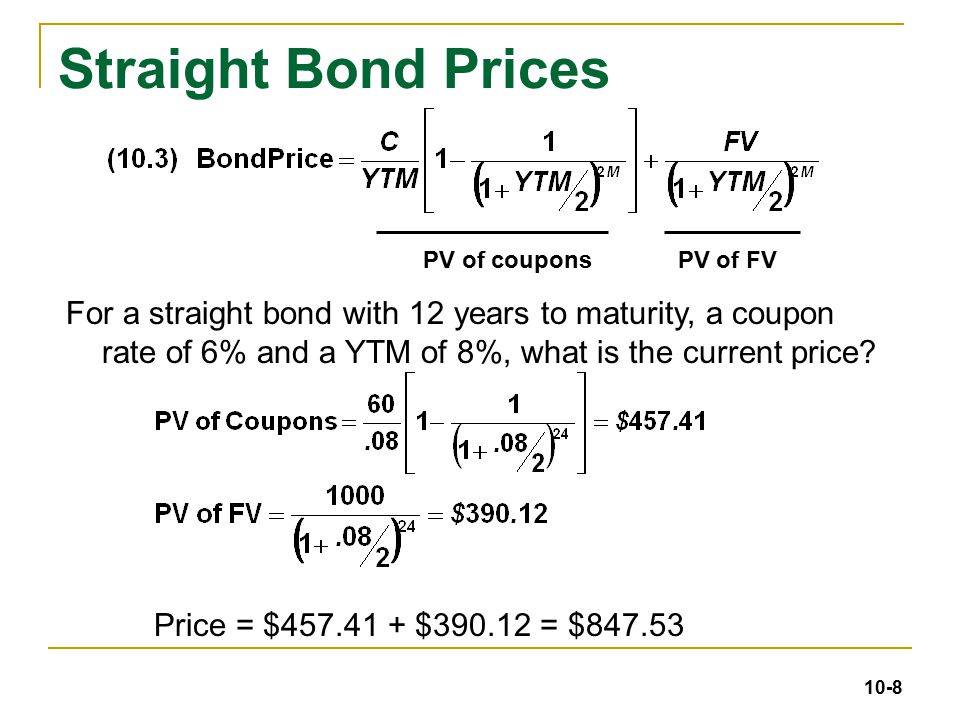

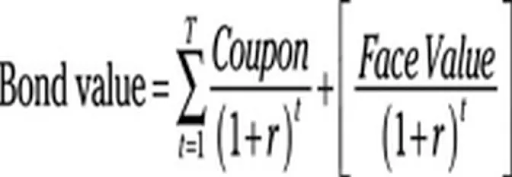

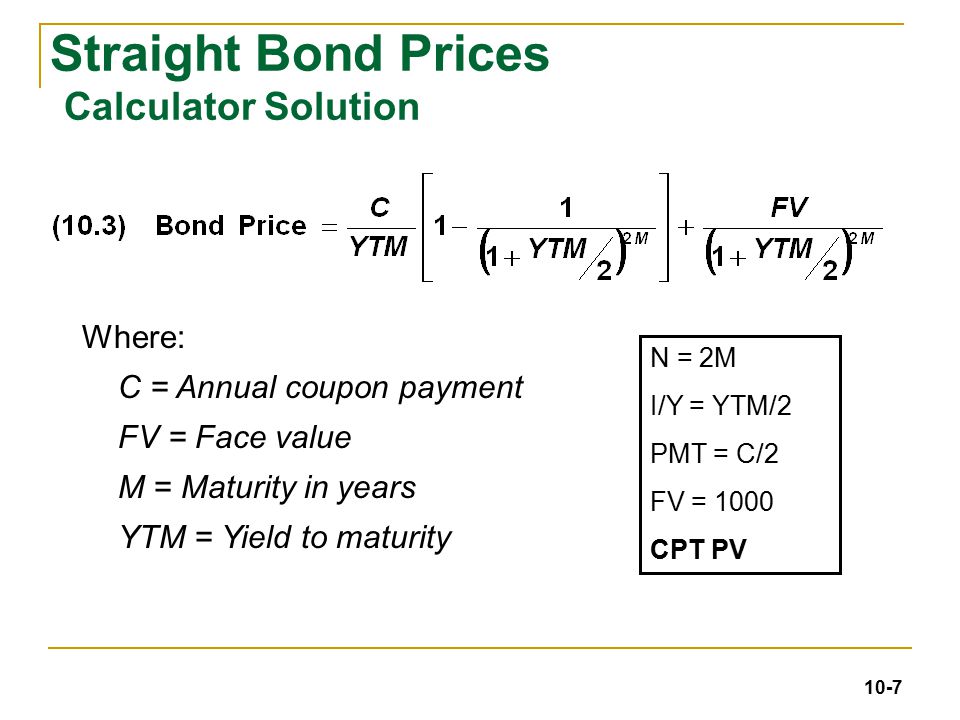

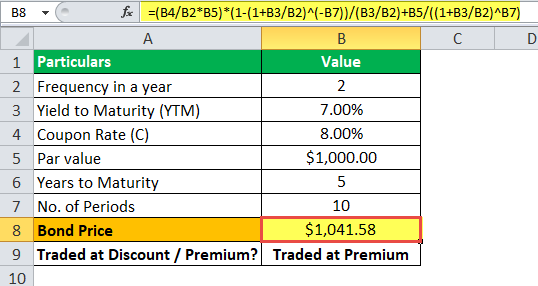

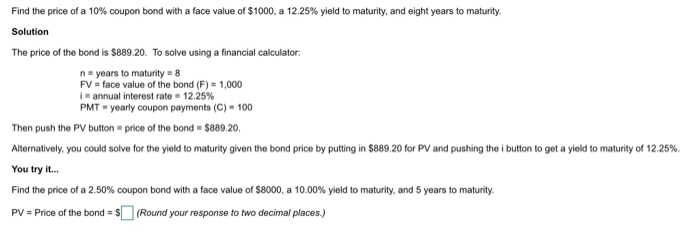

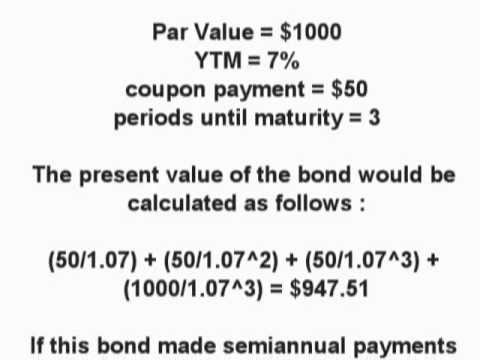

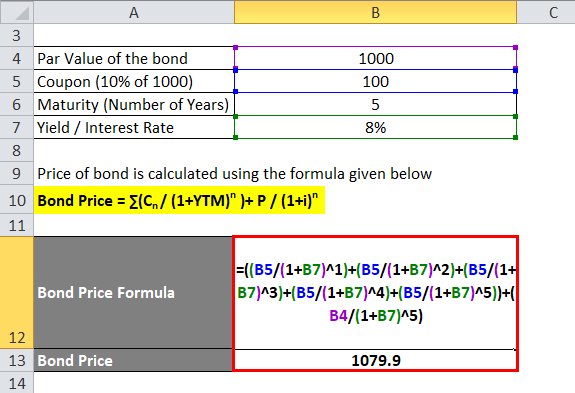

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Present Value of Annuity Formula | Calculator (With Excel … Present Value of Ordinary Annuity = $1,000 * [1 – (1 + 5%/4)-6*4] / (5%/4) Present Value of Ordinary Annuity = $20,624 Therefore, the present value of the cash inflow to be received by David is $20,882 and $20,624 in case the payments are received at the start or at the end of each quarter respectively.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

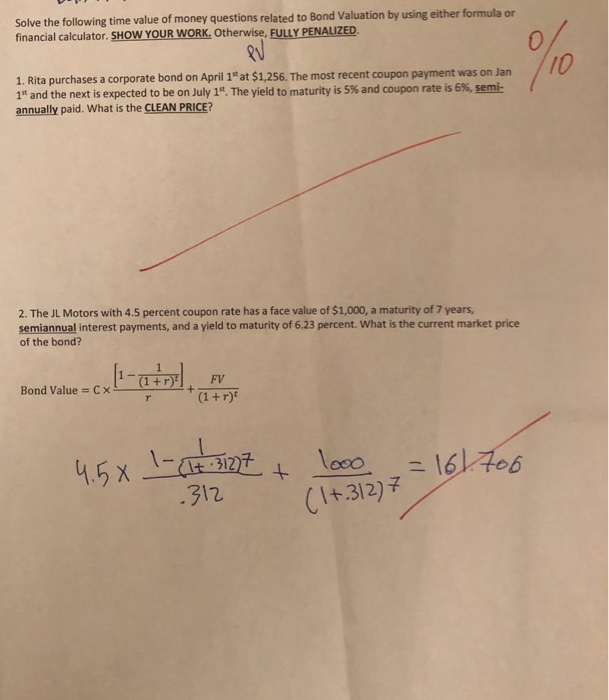

How do you find the present value of a coupon bond? How to calculate the net present value of a bond? The net present value of the cash flows of a bond added to the accrued interest provides the value of the Dirty Price. The Accrued Interest = (Coupon Rate x elapsed days since last paid coupon) ÷ Coupon Day Period.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

Bond Yield Calculator | Calculate Bond Returns coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest annually. Determine the years to maturity

› bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ...

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued.

Savings Bond Calculator — TreasuryDirect The Savings Bond Calculator WILL NOT: Provide accurate results for the value of electronic bonds. If you hold a bond in electronic form, log in to TreasuryDirect to find the value. Verify you own bonds. Guarantee the serial number you enter is valid. Guarantee a bond is eligible to be cashed. Create a savings bond based on information you enter.

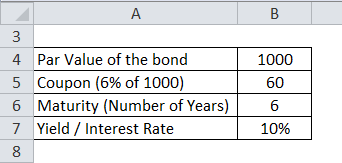

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $50 * [1 - (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) 1*9 Coupon Bond = $932

Present Value Of Bond Coupon Payment Calculator (3 days ago) Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon … Visit URL Category: coupon codes Show All Coupons

Bond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. ... BOND VALUE. Solve for PV. Cash Flows (N) Cash Flow (PMT) 6 Months Yield (i) ... Cash Flow. Annuity Factor. Present Face Value. Face Value. Discount Factor Instructions. Tweet ...

› present-value-of-annuity-formulaPresent Value of Annuity Formula | Calculator (With Excel ... Present Value of Ordinary Annuity = $1,000 * [1 – (1 + 5%/4)-6*4] / (5%/4) Present Value of Ordinary Annuity = $20,624 Therefore, the present value of the cash inflow to be received by David is $20,882 and $20,624 in case the payments are received at the start or at the end of each quarter respectively.

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity

Present Value Formula | Calculator (Examples with Excel … Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ...

Zero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

› calculator › present_value_calculatorPresent Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ...

![Discount Rate Formula: Calculating Discount Rate [WACC/APV]](https://www.profitwell.com/hs-fs/hubfs/NPVEquation%20(1).png?width=780&name=NPVEquation%20(1).png)

Post a Comment for "40 present value of coupon bond calculator"